The highs & lows of … planning application submissions, the last 6 months

Planning professionals across the land have been, and still are, submitting planning applications on all natures and scale on behalf of clients across the country. Whilst this has been occurring, a forensic analysis has been undertaken by EG Radius Data Exchange. Some interesting findings have emerged. A subtitle of “silver linings in lockdown” invites interesting reading and reflection.

Reporting on a downward trend towards lockdown (23 March), the numbers in April plunged to the lowest since 2016. However, the report does highlight a few interesting aspects, such as some parts of the country finding themselves with more large scale proposals, and particular sectors such as telecoms maintaining strong returns.

Some overall numbers to cogitate:

- Before 2020 there was an average of 6,796 planning decisions per month, so far, in 2020 there has been a 12.5% decline

- Slim pickings for approvals (up 1%) and refusals down (1%)

- 2% increase in the number of homes approved compared to the same time last year

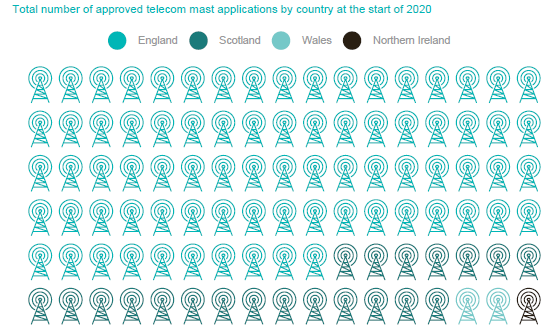

- 1,295 telecom mast applications as the nation gears up for 5G

- A 15.7% fall, year-on-year in applications submitted in the first 4 months of the year

Within the residential sector, negative figures strike (-25% for new applications, -29.2% for decisions) whilst office and commercial activity shoots up (21.2% new applications and 20.5% for decisions). Not surprisingly private housing is the largest sector for UK planning, accounting for more than half of decisions last year. Now its contribution has fallen 41.9%. A slight silver lining for this cloud is that social housing decisions are up 12.9% and new applications also up albeit at 4%. Bear in mind though, that social housing represents a total of only 3% of applications and decisions.

Across all sectors for applications, whilst offices and commercial applications leap by over 20% with a more modest 4% for social housing, apart from medical and scientific uses which remained static, all other sectors fell from between 8% (community and amenity) with the residential sector hitting -25%.

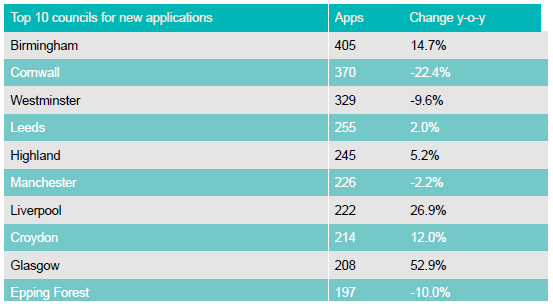

So, in an era of lockdown, the industry is looking to build new offices? Does not seem logical when the vast majority are working from home and find it, er … works! No, it is not the “office” tag which is resurging, rather the “commercial,” and within that lies the answer telecoms. With the nationwide ambition being for 5G coverage, our nation requires the relatively innocent telecoms mast. However, given our geography and the fact that 5G radio waves do not travel as far as 4G, the nation needs many of the innocent masts. In fact, they accounted for a third of all commercial and office decisions at the start of this year and more than 41% of all applications.

This may be the case but, according to the research, “Telecom masts have driven office and commercial activity, but only in certain parts of the country,” as evidenced in their graphic …

Turning to the residential sector, whilst although the number of new applications (-25.5%) and decisions (-29.2%) are down, approvals are on the up with a 7.2% rise to 210,973. On a similar level, the number of homes in applications submitted at the start of the year was up 13% on 2019 totalling 373,972.

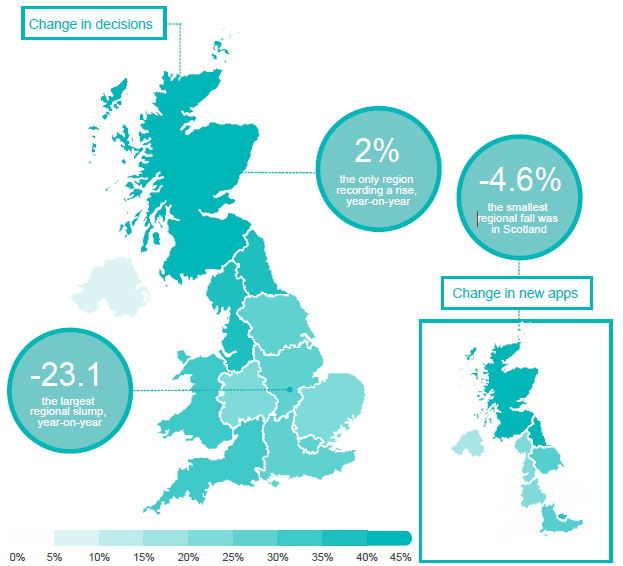

As a Scot myself, it is rare that across most sectors (other than whisky (not whiskey) and tartan) the country spends much time making positive noises. However, on the rather nerdier planning front, the country has much to shout about, with Scotland leading the way in planning activity at the start of this year.

A couple of graphic snapshots adequately demonstrate this …

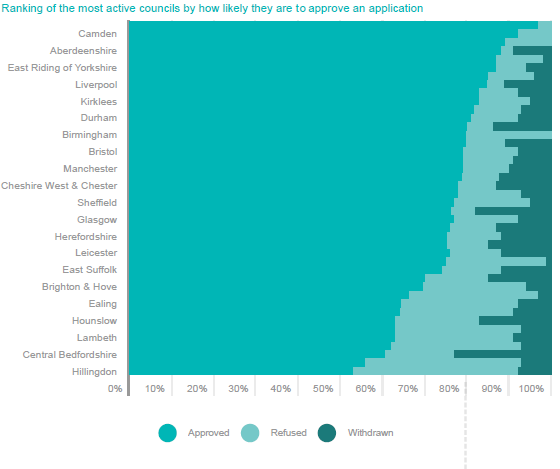

Whilst is would be rather pleasing to end on a positive, there is of the course the negative, planning permissions being refused with the report highlighting that “Greater London is home to eight of the councils most likely to refuse an application.”

So, from the above, it clear that planning has not ground to a halt. It is also clear that some sectors are holding their ground with one, telecoms, pulling the office and commercial sector to the top of the class. For the residential sector, whilst new applications and decisions are down, approvals are up for the same time last year. So, with permissions already in place, applications being submitted, certainly on the residential front it is over to the developers to get back out there and get those permissions implemented, or in real terms, build!

A copy of the analysis by EG Radius Data Exchange can be found here.